Open projects for students

These projects are open and are waiting for students to pick them up. If you are interested or would like to apply please contact the respective project supervisor.

Supervisor:

László Varga

This opportunity is at the intersection of quantitative finance and machine learning. It offers gaining experience in AIML coding and understanding various financial products and models with the general goal of speeding up pricing and calibration calculations with neural networks.... More

Application deadline:

October 15, 2024

MSc

Open

Time series generation, prediction and classification with variational autoencoders

Supervisor:

László Varga

This opportunity is at the intersection of quantitative finance and machine learning. It offers gaining experience in AIML coding and understanding various financial products and models with the general goal of speeding up pricing and calibration calculations with neural networks.... More

Application deadline:

October 15, 2024

MSc

Open

Supervisor:

Gábor Fáth

This opportunity is at the intersection of quantitative finance and machine learning. It offers gaining experience in AIML coding and understanding various financial products and models with the general goal of speeding up pricing and calibration calculations with neural networks.... More

Application deadline:

September 30, 2024

MSc

Open

Replication of financial pricing models with neural networks

Supervisor:

Gábor Fáth

This opportunity is at the intersection of quantitative finance and machine learning. It offers gaining experience in AIML coding and understanding various financial products and models with the general goal of speeding up pricing and calibration calculations with neural networks.... More

Application deadline:

September 30, 2024

MSc

Open

Running projects

The following projects are currently in progress. Student application has been closed, but if you are interested in a discussion please contact the respective project team.

Bence Ónódy, Gábor Fáth

This project offers an exciting opportunity for students to delve into the intricate realm of finance and risk management. Participants will grapple with the challenge of determining the optimal hedging strategy in a volatile multi-factor market, where hedging instruments are... More

MSc

Running

Optimal hedging under constraints

Bence Ónódy, Gábor Fáth

This project offers an exciting opportunity for students to delve into the intricate realm of finance and risk management. Participants will grapple with the challenge of determining the optimal hedging strategy in a volatile multi-factor market, where hedging instruments are... More

MSc

Running

Márton Jakovác, Gábor Fáth

VAEs are cutting-edge generative models that excel in capturing complex data distributions and generating new samples that closely resemble the original data. Through hands-on experience, students will develop a deep understanding of VAEs' architecture, training methodologies, and their role in... More

BSc

Running

Generating synthetic data using Variational Autoencoders

Márton Jakovác, Gábor Fáth

VAEs are cutting-edge generative models that excel in capturing complex data distributions and generating new samples that closely resemble the original data. Through hands-on experience, students will develop a deep understanding of VAEs' architecture, training methodologies, and their role in... More

BSc

Running

Dalma Tóth-Lakits, Miklós Arató, András Ványolos

This research focuses on the parameter estimation and calibration of interest rate models allowing for negative rates. We work with different models from Kennedy's random Gaussian field to sufficiently altered HJM and Black's models to shifted SABR. We investigate how... More

PhD

Running

Models of negative interest rates

Dalma Tóth-Lakits, Miklós Arató, András Ványolos

This research focuses on the parameter estimation and calibration of interest rate models allowing for negative rates. We work with different models from Kennedy's random Gaussian field to sufficiently altered HJM and Black's models to shifted SABR. We investigate how... More

PhD

Running

Zoltan Udvarnoki, Gabor Fath

Ground state wave functions of one-dimensional quantum chains are equivalent to classical time series with nontrivial statistical properties. This equivalence allows us to simulate time series for specific financial applications in a quantum inspired way.

PhD

Running

Quantum time series

Zoltan Udvarnoki, Gabor Fath

Ground state wave functions of one-dimensional quantum chains are equivalent to classical time series with nontrivial statistical properties. This equivalence allows us to simulate time series for specific financial applications in a quantum inspired way.

PhD

Running

Daniel Boros, Ivan Ivkovic, Laszlo Markus

Our interest is stochastic processes with fractional properties and their applications in financial mathematics. We work on parameter estimation methods for fractional Brownian motion, the OU and CIR processes, and the Heston model with rough volatility. We place emphasis on... More

PhD

Running

Fractional processes and their financial applications

Daniel Boros, Ivan Ivkovic, Laszlo Markus

Our interest is stochastic processes with fractional properties and their applications in financial mathematics. We work on parameter estimation methods for fractional Brownian motion, the OU and CIR processes, and the Heston model with rough volatility. We place emphasis on... More

PhD

Running

Closed projects

The following projects has been closed. For reports, publications, and other related material click the project link below.

Nándor Tóth, Gábor Fáth

This opportunity offers hands-on experience at the intersection of AI and quantitative finance, enhancing coding and data manipulation skills and the understanding of the statistical properties of real financial time series data.

MSc

Closed

Generating synthetic financial data using GANs

Nándor Tóth, Gábor Fáth

This opportunity offers hands-on experience at the intersection of AI and quantitative finance, enhancing coding and data manipulation skills and the understanding of the statistical properties of real financial time series data.

MSc

Closed

Zoltan Udvarnoki, Gabor Fath, Norbert Fogarasi

We examine the advantage of quantum computing for pricing financial options using the Monte Carlo method. Quantum MC promises a quadratic speedup over the classical algorithm. Systematic and statistical errors are handled in a joint framework, and a relationship to... More

PhD

Closed

Quantum advantage of Monte Carlo option pricing

Zoltan Udvarnoki, Gabor Fath, Norbert Fogarasi

We examine the advantage of quantum computing for pricing financial options using the Monte Carlo method. Quantum MC promises a quadratic speedup over the classical algorithm. Systematic and statistical errors are handled in a joint framework, and a relationship to... More

PhD

Closed

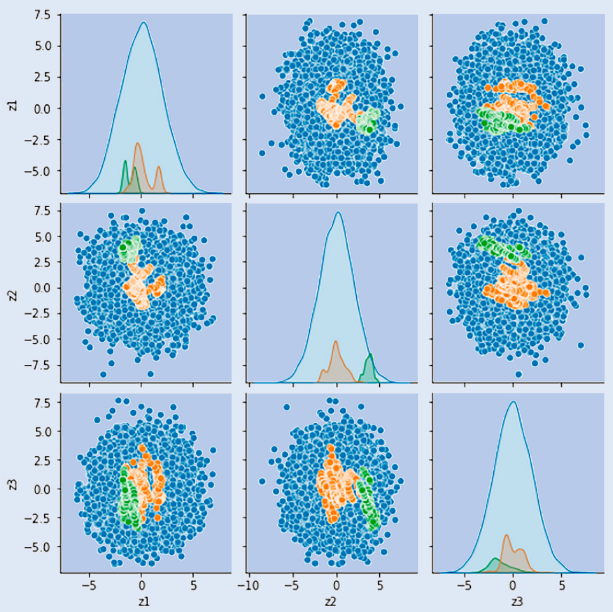

Máté Kunsági-Sándor, Gábor Molnár-Sáska, István Csabai, Gábor Fáth

We build Variational Autoencoders (VAE) to compress high-dimensional implied volatility surfaces. and connect this with the Weighted Monte Carlo approach to create a dynamic pricing framework, which can price not just vanillas, but also exotic options on this compressed vol... More

PhD

Closed

Deep Weighted Monte Carlo

Máté Kunsági-Sándor, Gábor Molnár-Sáska, István Csabai, Gábor Fáth

We build Variational Autoencoders (VAE) to compress high-dimensional implied volatility surfaces. and connect this with the Weighted Monte Carlo approach to create a dynamic pricing framework, which can price not just vanillas, but also exotic options on this compressed vol... More

PhD

Closed