Replication of financial pricing models with neural networks

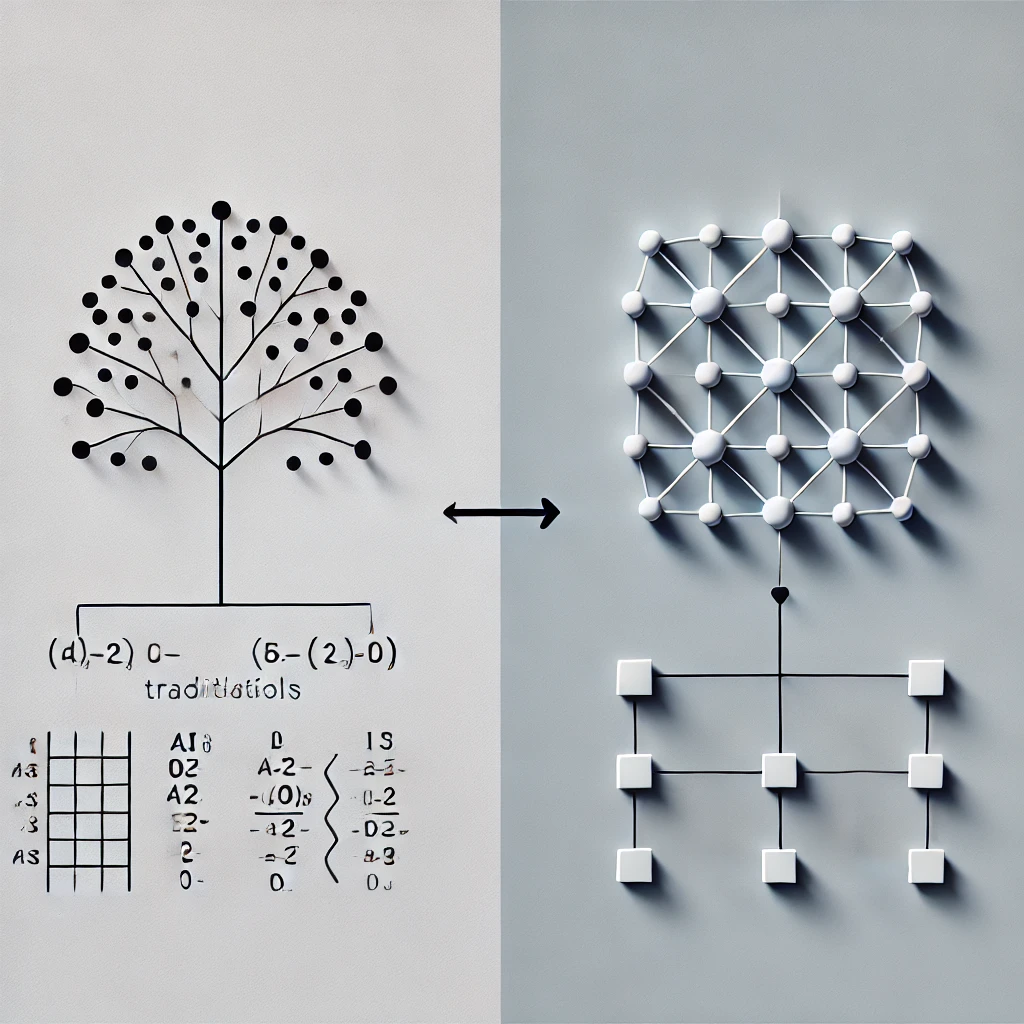

Pricing complex financial products is based on stochastic models. In many cases these models do not have closed form solutions and they should be handled by numerical methods such as pricing trees, discretized partial differential equations or Monte Carlo. These traditional pricing methods are usually slow, especially when used for model calibration. The project entails creating and training deep neural networks which could serve as fast alternatives to these problems. The network will be trained on random synthetic data generated by a slow solver. Optimal architecture, precision, robustness and reliability of these neural network replicators are the main questions to investigate.

How to apply

Application deadline: September 30, 2024

Pricing complex financial products is based on stochastic models. In many cases these models do not have closed form solutions and they should be handled by numerical methods such as pricing trees, discretized partial differential equations or Monte Carlo. These traditional pricing methods are usually slow, especially when used for model calibration. The project entails creating and training deep neural networks which could serve as fast alternatives to these problems. The network will be trained on random synthetic data generated by a slow solver. Optimal architecture, precision, robustness and reliability of these neural network replicators are the main questions to investigate.