Deep Weighted Monte Carlo

Team:

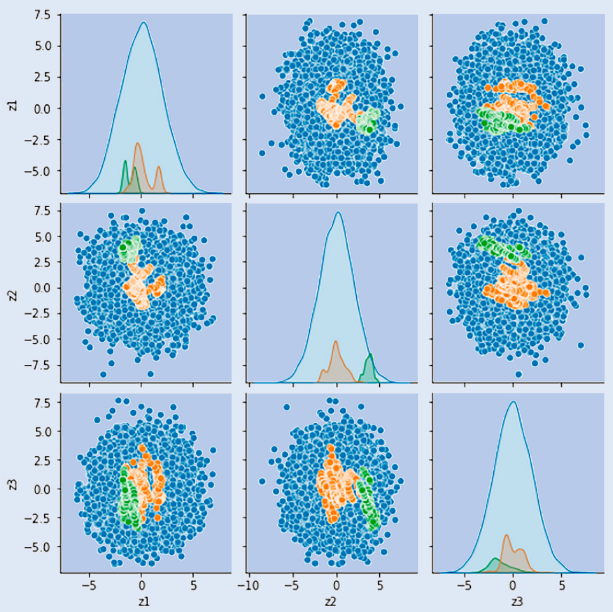

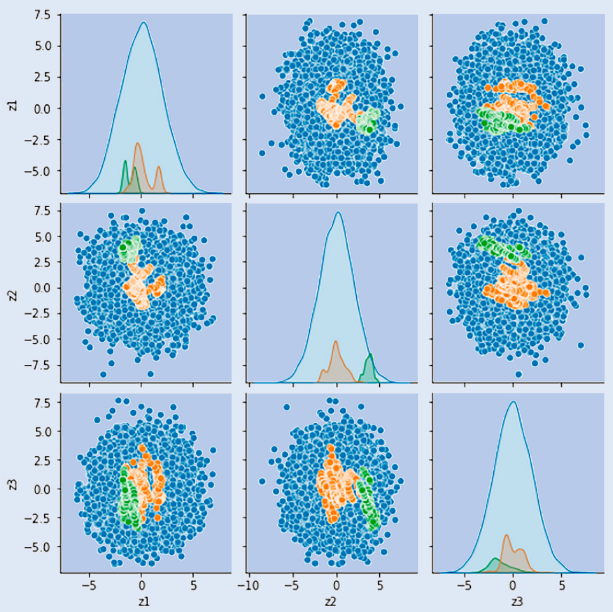

Recent studies have demonstrated the efficiency of Variational Autoencoders (VAE) to compress high-dimensional implied volatility surfaces. The encoder part of the VAE plays the role of a calibration operation which maps the vol surface into a low dimensional latent space representing the most relevant implicit model parameters. The decoder part of the VAE performs a pricing operation and reconstructs the vol surface from the latent (model) space. Since this decoder module predicts volatilities of vanilla options directly, it does not provide any explicit information about the dynamics of the underlying asset. It is unclear how the latent model could be used to price exotic, non-vanilla options. In this paper we demonstrate an effective way to overcome this problem. We use a Weighted Monte Carlo approach to first generate paths from a simple a priori Brownian dynamics, and then calculate path weights to price options correctly. We develop and successfully train a neural network that is able to assign these weights directly from the latent space. Combining the encoder network of the VAE and this new “weight assigner” module we are able to build a dynamic pricing framework which cleanses the volatility surface from irrelevant noise fluctuations, and then can price not just vanillas, but also exotic options on this idealized vol surface. This pricing method can provide relative value signals for option traders as well.

Key findings of the paper:

- We confirmed the success of Variational Autoencoders in compressing volatility surfaces into

low dimensional latent spaces in the swaption market. - We successfully extracted the physically meaningful information from the latent representation

of the market by translating the latent coordinates into weights of Monte Carlo paths. - We developed a hybrid approach by combining Deep Learning and Weighted Monte Carlo that

can price any type of option consistently with the latent model represented by the fully trained

VAE.

Published in: Quantitative Finance, 2023; https://doi.org/10.1080/14697688.2023.2181206

Recent studies have demonstrated the efficiency of Variational Autoencoders (VAE) to compress high-dimensional implied volatility surfaces. The encoder part of the VAE plays the role of a calibration operation which maps the vol surface into a low dimensional latent space representing the most relevant implicit model parameters. The decoder part of the VAE performs a pricing operation and reconstructs the vol surface from the latent (model) space. Since this decoder module predicts volatilities of vanilla options directly, it does not provide any explicit information about the dynamics of the underlying asset. It is unclear how the latent model could be used to price exotic, non-vanilla options. In this paper we demonstrate an effective way to overcome this problem. We use a Weighted Monte Carlo approach to first generate paths from a simple a priori Brownian dynamics, and then calculate path weights to price options correctly. We develop and successfully train a neural network that is able to assign these weights directly from the latent space. Combining the encoder network of the VAE and this new “weight assigner” module we are able to build a dynamic pricing framework which cleanses the volatility surface from irrelevant noise fluctuations, and then can price not just vanillas, but also exotic options on this idealized vol surface. This pricing method can provide relative value signals for option traders as well.

Key findings of the paper:

- We confirmed the success of Variational Autoencoders in compressing volatility surfaces into

low dimensional latent spaces in the swaption market. - We successfully extracted the physically meaningful information from the latent representation

of the market by translating the latent coordinates into weights of Monte Carlo paths. - We developed a hybrid approach by combining Deep Learning and Weighted Monte Carlo that

can price any type of option consistently with the latent model represented by the fully trained

VAE.

Published in: Quantitative Finance, 2023; https://doi.org/10.1080/14697688.2023.2181206